Nvidia's Phenomenal Rise in Market Capitalization

In a groundbreaking financial milestone, Nvidia has eclipsed Apple to assume the position of the second most valuable company globally, bolstered by an impressive market capitalization of $3.01 trillion. Standing only behind Microsoft, with a market cap of $3.15 trillion, Nvidia’s ascendancy underscores the burgeoning importance of artificial intelligence technologies. This development not only signals a pivotal shift in market dynamics but also highlights Nvidia's strategic moves and product innovations that have fueled its climb.

The bulwark of Nvidia's remarkable rise is its influential role in the artificial intelligence sector. Central to this narrative is Nvidia’s flagship H100 chip, a cornerstone product that has cemented the company’s dominance in the AI chip market. Nvidia’s AI accelerators command a staggering 70 to 95 percent of the market share, a testament to the company's cutting-edge technology and strategic foresight. This dominance has resulted in a significant spike in demand for Nvidia’s products, which in turn has buoyed its financial performance and market standing.

Financial Performance and Strategic Innovations

May 2023 marked a significant financial milestone for Nvidia, as the tech giant reported an unparalleled $14 billion profit. This financial windfall underscored Nvidia's successful navigation of the rapidly evolving tech landscape. The company’s trajectory has been nothing short of meteoric; Nvidia crossed the $1 trillion market cap threshold in May 2023, surged past $2 trillion in February 2024, and has now attained the $3 trillion mark. This astronomical growth reflects the growing adoption and integration of AI technologies across diverse sectors and underscores Nvidia's pivotal role in this transformation.

Amplifying this upward momentum is Nvidia's strategic plan to release a new AI chip annually. The forthcoming Blackwell B200 GPU, anticipated later this year, exemplifies the company’s commitment to relentless innovation and industry leadership. By continually pushing the boundaries of AI technology, Nvidia aims to sustain its market dominance and financial growth. This forward-thinking approach, coupled with its technical prowess, positions Nvidia to capitalize on the expanding AI market.

Stock Performance and Investor Engagement

Nvidia’s stock has mirrored its impressive market performance. The company's shares recently closed at an unprecedented high of $1,224.40 per share, reflecting robust investor confidence and endorsement of Nvidia's strategic direction. In a move aimed at broadening investor accessibility, Nvidia has announced a 10-for-1 stock split. Shares will be distributed post-trading on June 7th, with trading commencing on a split-adjusted basis on June 10th. This strategic initiative is designed to make Nvidia’s stock more accessible and attractive to a wider array of investors, potentially driving further investment and market engagement.

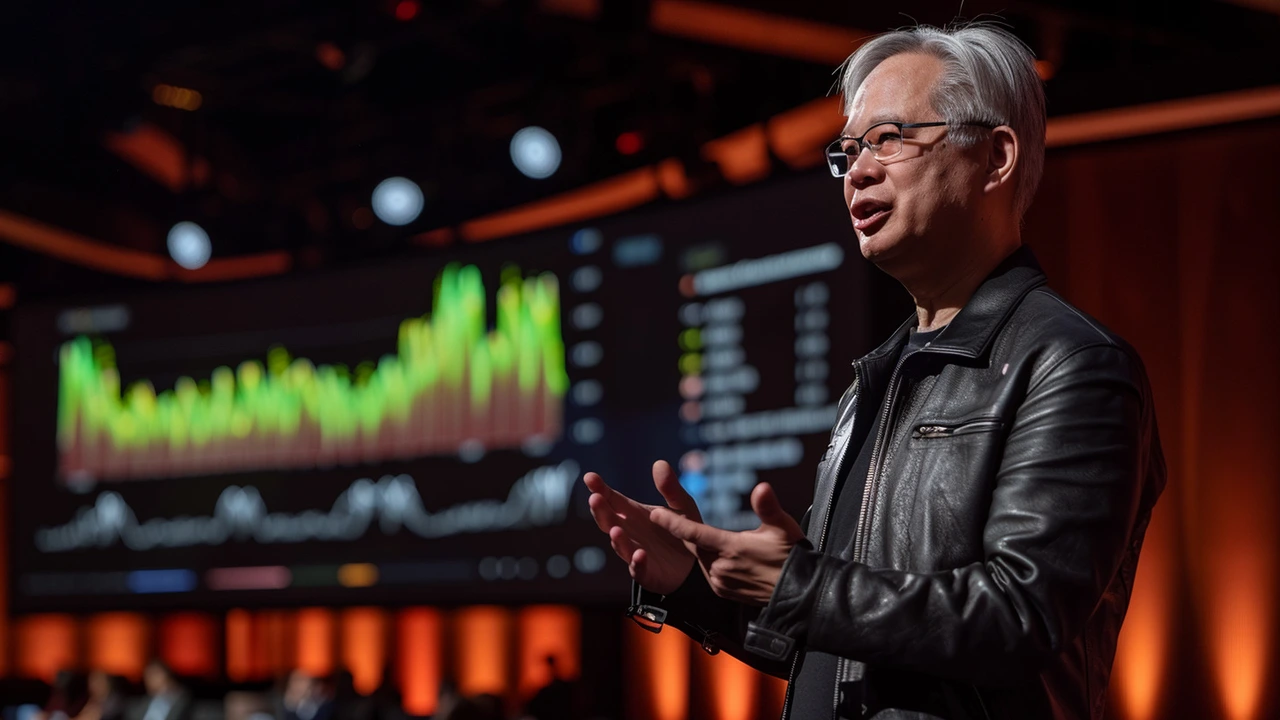

Leadership and Vision: The Role of CEO Jensen Huang

Nvidia’s remarkable ascent is inextricably linked to the visionary leadership of CEO Jensen Huang. At the forefront of Nvidia’s strategic direction, Huang has been instrumental in steering the company towards its current stature. His presentations at Computex 2024 in Taipei were particularly impactful, emphasizing the transformative potential of AI and Nvidia’s dedication to innovation. Huang articulated a vision where AI revolutionizes the generation and utilization of information, heralding a paradigm shift from traditional computing methods that have long been the industry standard.

Central to Nvidia's strategic initiatives are its partnerships with other tech industry titans. Collaborations with companies like Taiwan Semiconductor Manufacturing Company (TSMC) are crucial in advancing Nvidia’s technological capabilities and expanding its market reach. These alliances not only enhance Nvidia’s product offerings but also solidify its position as a leader in the AI sector.

The Importance of AI Technologies Across Industries

This monumental rise in Nvidia’s market value is indicative of a broader trend – the escalating importance and adoption of AI technologies across various industries. From healthcare to finance, and from manufacturing to entertainment, artificial intelligence is redefining the way businesses operate and services are delivered. Nvidia’s technologies are at the heart of this transformation, providing the computational power and sophisticated algorithms that enable cutting-edge AI applications.

The significance of AI technology cannot be overstated. In healthcare, AI-driven diagnostics and treatment plans are improving patient outcomes and reducing costs. In finance, AI algorithms are revolutionizing trading strategies and risk management practices. In manufacturing, AI-powered automation is enhancing efficiency and productivity. These applications underscore the pervasive impact of AI and the crucial role of companies like Nvidia in driving this technological revolution.

Future Prospects and Industry Impact

Looking ahead, Nvidia’s focus on innovation and strategic growth positions it to continue shaping the future of AI technology. The anticipated release of the Blackwell B200 GPU later this year is just one example of the company’s commitment to pushing the envelope in AI development. By continuing to innovate and expand its product offerings, Nvidia aims to maintain its market leadership and capitalize on the growing demand for AI technologies.

Moreover, Nvidia’s strategic initiatives, such as the annual release of new AI chips and the 10-for-1 stock split, reflect a forward-thinking approach to market engagement and investor relations. These moves are designed to enhance Nvidia’s market presence, foster investor confidence, and drive sustained financial growth.

In conclusion, Nvidia’s ascent to a market capitalization of $3.01 trillion is a testament to its strategic vision, innovative prowess, and influential role in the AI sector. As the company continues to push the boundaries of artificial intelligence, it is poised to remain a dominant force in the tech industry, shaping the future of AI and driving technological advancements across various sectors.